-

Tired of adverts on RWI? - Subscribe by clicking HERE and PMing Trailboss for instructions and they will magically go away!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CF Pepsi picture leaks BLRO

- Thread starter wolfiqar

- Start date

- 4/9/20

- 2,880

- 3,467

- 113

I think buying a Pepsi is a sure thing you won’t lose (unless you sell it immediately). Hulk took a huge jump in value once it was discontinued. This will be discontinued one day, and when it does that’ll be a good day to own one, don’t need a crystal ball to foretell that.

On that subject, it’s been 14-15yrs since we got a new GMT, the previous generation Sub lasted 10yrs before it was redesigned. I bet a new GMT is on the horizon during this 20’s decade. Maybe putting $$$$$ into a Pepsi today would be long term smart investment.

On that subject, it’s been 14-15yrs since we got a new GMT, the previous generation Sub lasted 10yrs before it was redesigned. I bet a new GMT is on the horizon during this 20’s decade. Maybe putting $$$$$ into a Pepsi today would be long term smart investment.

muiramas

Aristocrat

- 18/1/17

- 6,047

- 7,959

- 113

I think buying a Pepsi is a sure thing you won’t lose (unless you sell it immediately). Hulk took a huge jump in value once it was discontinued. This will be discontinued one day, and when it does that’ll be a good day to own one, don’t need a crystal ball to foretell that.

A sure thing? Just 5 years ago you could have walked out of an AD with a Hulk at or below MSRP. Assuming that prices will continue their trajectory for another 5 is far from a sure thing. The 116XXXX Submariner in general never spiked after September 2020 - the LV was already a hyped model.

On that subject, it’s been 14-15yrs since we got a new GMT, the previous generation Sub lasted 10yrs before it was redesigned. I bet a new GMT is on the horizon during this 20’s decade. Maybe putting $$$$$ into a Pepsi today would be long term smart investment.

Your 126710 is the new GMT - launched in 2018. It replaces the 116710 sold between 2007 - 2018. So assuming there is another 10 year product cycle, there won’t be an update until 2028 - on the distant horizon maybe.

Who knows right? Purely from an investors point of view, basing the next 5 years on the previous 5 is something no one does. Trends and growth patterns shift - that’s where real investors make their money.

Last edited:

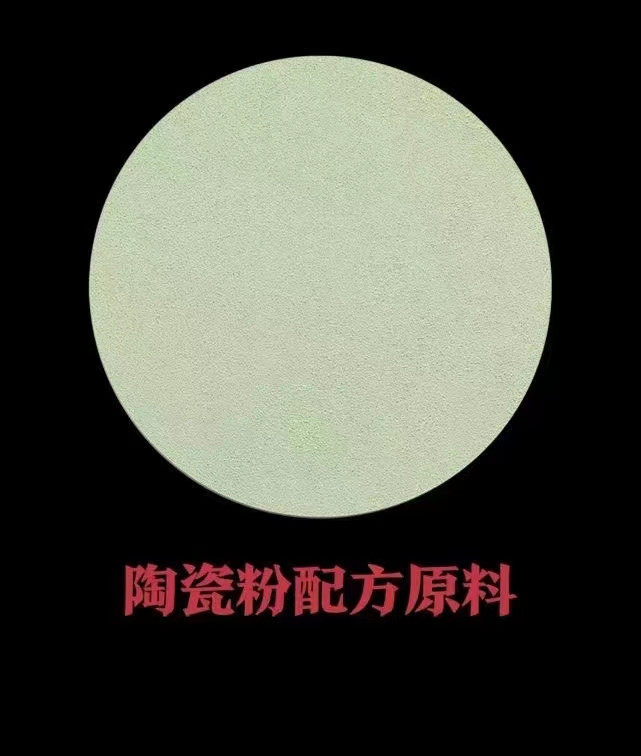

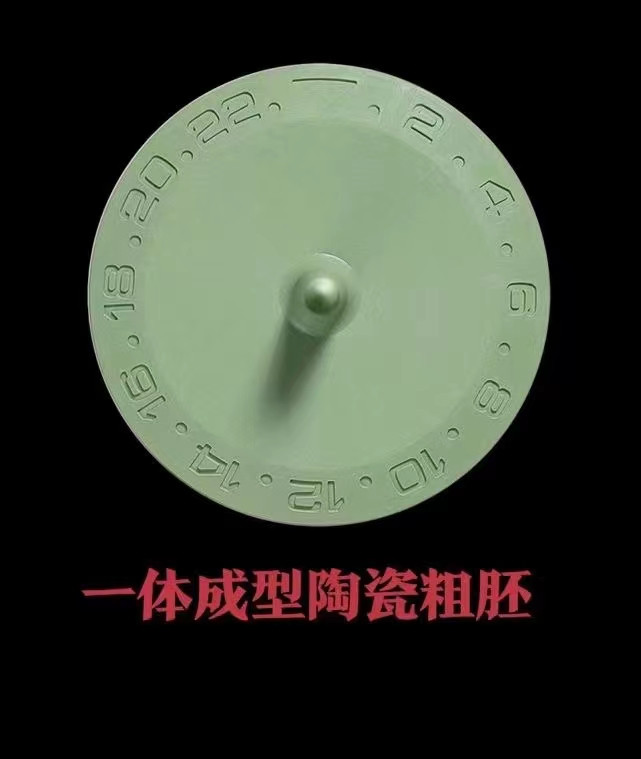

Anyways in case you wonder how Clean makes their inserts.

Would you mind translating, my Chinese is a bit rusty?

Or at least explain what we’re looking at, as in what those individual steps are?

And all your industry insights are much appreciated!

- 20/4/08

- 398

- 96

- 28

- 4/9/20

- 2,880

- 3,467

- 113

I’m not an investor. I bought it because I like the look of it and to wear the heck out of it, and I do. Most folk who own these keep them in the box. The fact it may appreciate made the decision to buy it all the easier though. I would not have bought it if the value tanked as soon as you leave the store.

I’ll keep it a while then trade it in for a 18k sub or gmt.

I’ll keep it a while then trade it in for a 18k sub or gmt.

Last edited:

vipstyle888

Known Member

Inviato dal mio iPhone utilizzando Tapatalk

Mate, did you change the crystal gasket when you changed the crystal and dw? What else did you replace if I may ask? Was planning to have a simple franken like yours. I can't stand the wrong magnification and bolder dw. :thumbsup:

I’m not an investor.

I think that's a given. Given your take on assets and appreciation and lack of knowledge on what a speculative market is...

Watches, particularly Rolex are a traditional asset bubble. Look at every asset bubble that has ever existed, they eventually pop. It might take 10 years, it might take 20. Maybe even 50, who knows. But 'No King rules forever' and that includes Rolex. Rolex are only popular now, will it stay that way who knows? Arguably it will, Rolex have the same brand strength as Coca Cola, it's that synonymous. But nothing in life is guaranteed except death and taxes. (look at previous booms / busts - Dotcom for example)

Rolex right now are a fantastic speculative investment for quick returns. Long-term its questionable, but short-term they're one of the most liquid tangible assets you could possibly own (right now). But as with all investments, and all investment companies have a compulsory regulatory statement that says something along the lines of 'history is not an accurate predictor of the future, your returns may vary'. There's a reason we put this disclosure up. History isn't a good predicator. You can look at the CAPM (Capital Asset Pricing Model) and that will show you what using history as predictor gets you. Fama and French (if I remember their names correctly, been a while since I studied financial theory) they improved upon it, but even with their adjustments. History is borderline useless. A fantastic example of this is a recent company called NMC Health... (Dubai based Healthcare trust) - They lied, for ~3 years on their financial statements, claiming they were in profit. Thus institutional investors used this information and viewed the company as undervalued, and thus invested millions upon millions into this company. Well if you check their recent history... you'll find they're no longer active on a stock market. Their fraud was found out and yeah... everyone invested has lost money. Fun times.

Lastly, you also don't understand the concept of time to money value, ie inflation. If you buy a watch today at £10,000, and sell it next year for £11,000. You have not made £1,000. You have made less than a £1,000 because of inflation. As for a measure for inflation, well that depends if you judge by RPI/CPI or if you look at the price of goods. Even conservative estimates of real world inflation are around 3%-5%. All is not as it seems with money... it isn't black and white, and that's why we have the financial markets and financial institutions. So you can't base your calculations on the assumption that money will always have the same buying power.

Furthermore this ignores monetary and fiscal policy, ie the supply of money and the value of money. For example, your national bank, Bank of England, has a set target for inflation of around 2%. They achieve this by modifying the interest rate. Interest is effectively the cost of borrowing, or more how expensive money is.

When interest rates are low, inflation becomes higher as the cost of borrowing money is cheaper and thus buying power reduces (as more people borrow money). It's the reason the UK Housing market is so insane right now, prices are massively inflated because the cost of borrowing money is very low. Right now we're in incredible low interest times thus you would expect inflation to raise. Plus, with Quantitive Easing measures we're likely to see money devalue very quickly. So all is not how/what it seems. Comparing buying power for example... Oil Prices... Grain Prices... Precious Metals, these are good indicators to use to find the true value of money.

This is why you cannot compare money across time, easily at least.

Anyway TLDR, top tip. Don't pay more than 20% above retail for anything that is an asset bubble. Even if you end up losing certain returns, your capital should be protected. And find a more accurate way of measuring moneys future value. (NPV)

- 4/9/20

- 2,880

- 3,467

- 113

Peguine

Mac and Cheese sucks

I think that's a given. Given your take on assets and appreciation and lack of knowledge on what a speculat......

yes yes yes this is important. Overconfidence in an asset's long-term future value is nothing but foolish. Dust to dust and rolex is not immune to the cyclical effects of the market no matter what crown it has. The pepsi is one of the most hyped watches in the market with many watch dealers holding on to multiple and hundreds on the market right now (300+ on chrono24) this is a steel watch going at 20+K usd all day. This kind of pricing is unsustainable, potential buyers at this high asking price are limited and not all of the market want to pay premiums. It's just a matter of time when there are very few customers willing to pay premiums, at that point the price will fall, the premium is ridiculous for a high production watch like this. It isn't a 5711 or 15202 where there weren't many made in a year. That's just my 2c

Mate, did you change the crystal gasket when you changed the crystal and dw? What else did you replace if I may ask? Was planning to have a simple franken like yours. I can't stand the wrong magnification and bolder dw. :thumbsup:

All gen friend: gasket, crystal and dw

Inviato dal mio iPhone utilizzando Tapatalk

alexcast

Active Member

- 23/6/19

- 224

- 173

- 43

I prefer to invest on real state I build on my own instead of watch overprice speculation, watches are to enjoy and show off, real state last longer and appreciate faster than a watch, buying a watch is not investment it’s an expenditure but everybody can spend their money as they like ????

Enviado desde mi iPhone utilizando Tapatalk

Enviado desde mi iPhone utilizando Tapatalk

alexcast

Active Member

- 23/6/19

- 224

- 173

- 43

My over priced hard to get watch.

Its not over priced if you buy at retail. Retail is a discount. You won’t get one at retail though.

However if you do acquire one at grey price it’ll still appreciate. I paid full grey price for mine and it has already appreciated some that now if I sold it tomorrow I’d get all my money back, all of it.. so right now, I’m wearing this for nothing. Soon, it’ll be in profit. When it eventually gets discontinued it’ll go stratospheric.

That’s a good race to have a horse in.

So, you think you’re an investor and an entrepreneur for buying a watch for 9,000 and reselling it on 19,000. My friend that not investing that is what the market calls speculating and if you brag about earning just 10,000 usd I guess that the Chinese guy behind CF makes that an hour, the Chinese guy is the real entrepreneur, not you

Enviado desde mi iPhone utilizando Tapatalk

- 4/9/20

- 2,880

- 3,467

- 113

So, you think you’re an investor and an entrepreneur for buying a watch for 9,000 and reselling it on 19,000. My friend that not investing that is what the market calls speculating and if you brag about earning just 10,000 usd I guess that the Chinese guy behind CF makes that an hour, the Chinese guy is the real entrepreneur, not you

Enviado desde mi iPhone utilizando Tapatalk

No.. wtf is this?

I paid grey price for my watch.

I'm not on here bragging about nothing.

Last edited:

yes yes yes this is important. Overconfidence in an asset's long-term future value is nothing but foolish. Dust to dust and rolex is not immune to the cyclical effects of the market no matter what crown it has. The pepsi is one of the most hyped watches in the market with many watch dealers holding on to multiple and hundreds on the market right now (300+ on chrono24) this is a steel watch going at 20+K usd all day. This kind of pricing is unsustainable, potential buyers at this high asking price are limited and not all of the market want to pay premiums. It's just a matter of time when there are very few customers willing to pay premiums, at that point the price will fall, the premium is ridiculous for a high production watch like this. It isn't a 5711 or 15202 where there weren't many made in a year. That's just my 2c

I do not disagree with your statements, as I had the same view couple years back.

However, the fact is that the prices have held up pretty well and in some cases still continue to creep north.

And your example of a limited production watch like the 5711, the exorbitant premiums have also been priced in. It’s all relative.

I’m just sour I don’t have the means to participate in this price craze ????

Sent from my iPhone using Tapatalk

I do not disagree with your statements, as I had the same view couple years back.

However, the fact is that the prices have held up pretty well and in some cases still continue to creep north.

And your example of a limited production watch like the 5711, the exorbitant premiums have also been priced in. It’s all relative.

I’m just sour I don’t have the means to participate in this price craze ????

Sent from my iPhone using Tapatalk

just get the CF Pepsi and forget about it.

Hi all

I just received my CF Pepsi

The one flaw that I thought that would bother me the most, was the too short hour hand!

And it is there, very obvious o_o

Does it bother me? Yes!

Does it bother me enough to not wear the watch because of it? Hell no!

I have a gen crystal ready to put on. I might have the rehaut polished as well.

This will keep me happy until I move up on the waiting list, or a better rep comes out.

Here a few quick snaps:

I just received my CF Pepsi

The one flaw that I thought that would bother me the most, was the too short hour hand!

And it is there, very obvious o_o

Does it bother me? Yes!

Does it bother me enough to not wear the watch because of it? Hell no!

I have a gen crystal ready to put on. I might have the rehaut polished as well.

This will keep me happy until I move up on the waiting list, or a better rep comes out.

Here a few quick snaps:

Last edited:

Sorry to quote all the pics, these photos actually look very similar to the Rolex process. 1st few stages anyway, obviously the bi colour part of the process is different but pretty good effort from CF. 2nd last photo is from millenary watch site though

Sent from my iPhone using Tapatalk

- 30/5/21

- 1,423

- 4,189

- 113

Finally received those two beauties! (before flaming, I know this is a BLRO thread, just posting the pics for discussion and comparison purposes)

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk