-

Tired of adverts on RWI? - Subscribe by clicking HERE and PMing Trailboss for instructions and they will magically go away!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

You Don't Know How Good You Have It With Obama

- Thread starter arcadia

- Start date

Do you realize if you earn over 250k you pick up additional taxes, and in the even that you are a business owner, the ACA kicks in and can potentially lead to even more taxes and fees that you are responsible. Before I hear the BS of if you earn that much you should pay your fair share.

Do you realize that income taxes on the wealthy are at an all time low for this generation.

Since WWII until the late 60's tax rates on the rich were approx 90%. Then through the 80's the rates fell down into the 70's. It's now at 34% before deductions, loopholes, dodges and scams. Almost none of the rich actually pay that 34% which is quoted so often.

The rich just keep getting richer -- not only by gobbling up more income, but also by paying less in taxes. That means less support for the poor, who are getting increasingly poorer relative to the top one percent.

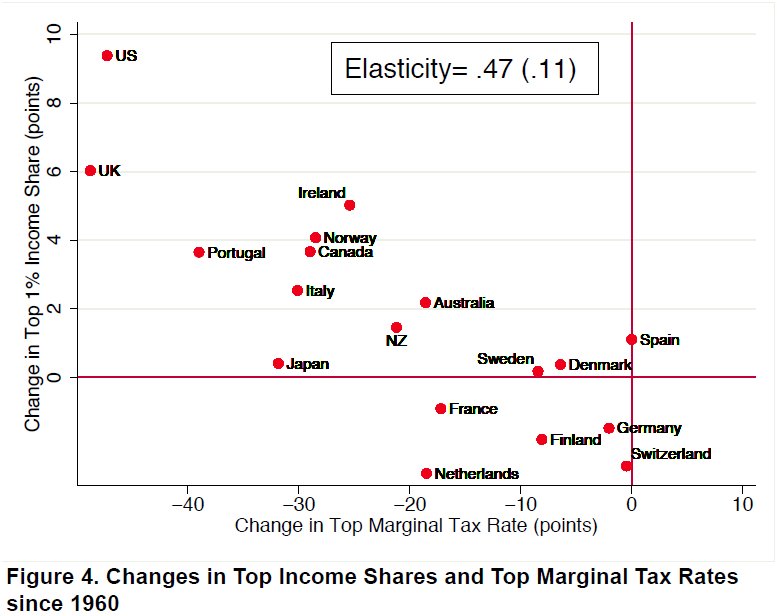

One chart in a new study of income inequality in developed nations, published by the National Bureau of Economic Research, puts this in stark relief. It shows that the more top tax rates are cut, the greater the share of national income that is mopped up by the wealthiest citizens.

And of course perhaps no country illustrates this better than the United States, which is at the extremes of income inequality and tax cuts for the wealthy, as you can see in the chart below. The only other nation that even comes close is the United Kingdom, which was hijacked by "trickle-down economics" at about the same time as the U.S., back in the 1980s under Reagan and Thatcher. (Story continues below infuriating chart.)

The U.K. has cut top tax rates more aggressively than the U.S. in the past few decades, but the U.S. still has a lower top marginal income tax rate -- 35 percent, compared to 50 percent in the U.K. And income inequality is far worse in the U.S., where the top one percent of households gets a fifth of all the nation's income. In the U.K., the income share of the top one percent is less than 15 percent.

Slashing top tax rates has had none of the positive effects on economic growth that the supply-side economists promised us, the NBER paper points out. Instead, it has just worsened income inequality.

There are other factors driving income disparity, including a rise in investment income (think stock dividends) compared to earned income (think wages). The recently soaring stock market, helped along by the Federal Reserve, is only pushing investment income higher. Wage income, in contrast, has been stagnant -- making income inequality even worse.

As if that weren't enough, investment income is typically taxed at lower rates, further amplifying the disparity. That means this chart doesn't begin to tell the full story of just how little the top one percent are paying in taxes. Mitt Romney isn't paying 35 percent on most of his income. He's calling his private-equity income "carried interest" and paying just 15 percent on it.

While Congress frantically finds ways to slash spending to close budget deficits, it has shown little interest in tweaking the tax code to make it more fair. Efforts to impose a minimum tax on millionaires, as Warren Buffett has suggested, have gone nowhere, as have efforts to do away with low carried-interest income tax rates. President Obama this year made permanent many of the top-rate tax cuts of President George W. Bush, while a payroll-tax cut that most benefited the poor was allowed to expire.

Similarly, U.S. companies aren't paying anywhere near the 35 percent statutory tax rate they complain about all the time, pushing for even lower rates. They shelter their income offshore and find other loopholes to slash their tax bill, helping reduce the share they contribute to federal coffers.

With corporations and the wealthy paying less and less of their share, the burden of protecting society's most vulnerable is falling more and more to the people who can afford it least.

Another way the ACA is hurting Americans is the fact that employers are now hiring more part time people and not full time...why, not out of greed, but business decisions. Its a matter of survival.

That started lonnnng before the ACA. That little trick started accelerating back when the economy was tanking under Bush's administration and companies realized they could get away with cutting all benefits to part timers that they hadn't already been able to cut from full time workers.

A perfect and prime example of that strategy was when Home Depot, who used to hire many professional tradesmen and pay decent wages hired Bob Nardelli from GE as their new CEO in 2000. His strategy was to cut workers and workers pay substantially. As a long time HD customer and stockholder my opinion is that this strategy almost ruined Home Depot. Luckily they wised up and fired Nardelli in 2006.

"Nardelli angered people by firing long-time Home Depot executives and bringing in GE alumni, according to Henderson. He also increased the number of less knowledgeable part-time workers at Home Depot’s stores, which left full-time employees fuming and led to a diminishment of customer service, one of the company’s strengths. From the very beginning of his tenure, Nardelli, now 58, “damaged morale, and he was seen as a real threat to the Home Depot culture,†Henderson says." http://knowledge.wharton.upenn.edu/...tenure-at-home-depot-a-blueprint-for-failure/

Ok, so I bring up small business owners and you bring up things Home Depot looked at doing. Apples and oranges.

I'm not here to get into a pissing match, but I meet with business owners on a daily basis. Look they are the drivers of the economy. They are the ones that hire others to provide goods and services. They are the ones that keep the country moving, not the damn government.

These are the folks that are stressed like hell when it comes time to pay taxes. They are the ones that have to make those hard decisions and figure do I stay where I am or try to grow. I'm tasked with helping them come to those conclusions and make recommendations. Its not easy. Not at all. But it is what it is.

But once we get to a place where more ppl in this country actually pay an income tax than don't, and I don't mean 51-49% we are going to have a problem. Social programs are fine, but should be a crutch to help ppl by, not a way of life. And imagine how much better the jobs will be once the illegals are legalized. Gonna be nasty.

But anyways. This is just the opinion of a mid 30's MBA educated person that works in the trenches with business owners and high net worth individuals. Guess I would know more if I just watched MSNBC and CNN. They say everything in perfect. Oh and I hope those of you investors out there are getting ready for a market crash. Just wait till QE slows down a bit, banks will pull money out of the markets, and if interest rates go up, there goes the bond market. Hope you have a strategy for saving your ass. Esp if you are getting close to retirement age. Just sayin.....

I'm not here to get into a pissing match, but I meet with business owners on a daily basis. Look they are the drivers of the economy. They are the ones that hire others to provide goods and services. They are the ones that keep the country moving, not the damn government.

These are the folks that are stressed like hell when it comes time to pay taxes. They are the ones that have to make those hard decisions and figure do I stay where I am or try to grow. I'm tasked with helping them come to those conclusions and make recommendations. Its not easy. Not at all. But it is what it is.

But once we get to a place where more ppl in this country actually pay an income tax than don't, and I don't mean 51-49% we are going to have a problem. Social programs are fine, but should be a crutch to help ppl by, not a way of life. And imagine how much better the jobs will be once the illegals are legalized. Gonna be nasty.

But anyways. This is just the opinion of a mid 30's MBA educated person that works in the trenches with business owners and high net worth individuals. Guess I would know more if I just watched MSNBC and CNN. They say everything in perfect. Oh and I hope those of you investors out there are getting ready for a market crash. Just wait till QE slows down a bit, banks will pull money out of the markets, and if interest rates go up, there goes the bond market. Hope you have a strategy for saving your ass. Esp if you are getting close to retirement age. Just sayin.....

Do you realize that income taxes on the wealthy are at an all time low for this generation.

Since WWII until the late 60's tax rates on the rich were approx 90%. Then through the 80's the rates fell down into the 70's. It's now at 34% before deductions, loopholes, dodges and scams. Almost none of the rich actually pay that 34% which is quoted so often.

The rich just keep getting richer -- not only by gobbling up more income, but also by paying less in taxes. That means less support for the poor, who are getting increasingly poorer relative to the top one percent.

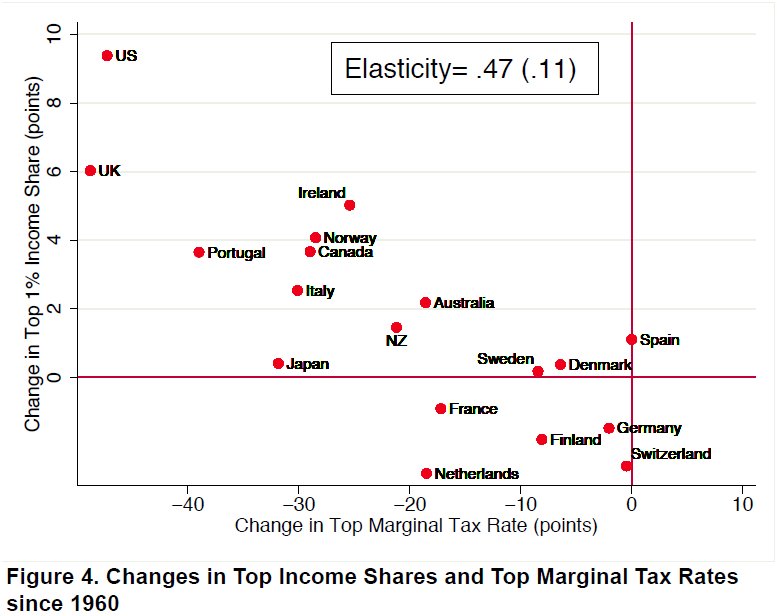

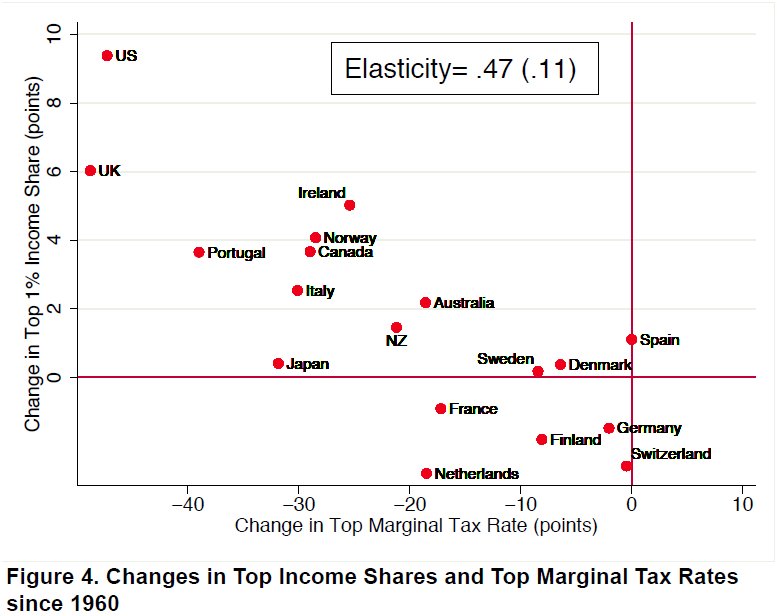

One chart in a new study of income inequality in developed nations, published by the National Bureau of Economic Research, puts this in stark relief. It shows that the more top tax rates are cut, the greater the share of national income that is mopped up by the wealthiest citizens.

And of course perhaps no country illustrates this better than the United States, which is at the extremes of income inequality and tax cuts for the wealthy, as you can see in the chart below. The only other nation that even comes close is the United Kingdom, which was hijacked by "trickle-down economics" at about the same time as the U.S., back in the 1980s under Reagan and Thatcher. (Story continues below infuriating chart.)

The U.K. has cut top tax rates more aggressively than the U.S. in the past few decades, but the U.S. still has a lower top marginal income tax rate -- 35 percent, compared to 50 percent in the U.K. And income inequality is far worse in the U.S., where the top one percent of households gets a fifth of all the nation's income. In the U.K., the income share of the top one percent is less than 15 percent.

Slashing top tax rates has had none of the positive effects on economic growth that the supply-side economists promised us, the NBER paper points out. Instead, it has just worsened income inequality.

There are other factors driving income disparity, including a rise in investment income (think stock dividends) compared to earned income (think wages). The recently soaring stock market, helped along by the Federal Reserve, is only pushing investment income higher. Wage income, in contrast, has been stagnant -- making income inequality even worse.

As if that weren't enough, investment income is typically taxed at lower rates, further amplifying the disparity. That means this chart doesn't begin to tell the full story of just how little the top one percent are paying in taxes. Mitt Romney isn't paying 35 percent on most of his income. He's calling his private-equity income "carried interest" and paying just 15 percent on it.

While Congress frantically finds ways to slash spending to close budget deficits, it has shown little interest in tweaking the tax code to make it more fair. Efforts to impose a minimum tax on millionaires, as Warren Buffett has suggested, have gone nowhere, as have efforts to do away with low carried-interest income tax rates. President Obama this year made permanent many of the top-rate tax cuts of President George W. Bush, while a payroll-tax cut that most benefited the poor was allowed to expire.

Similarly, U.S. companies aren't paying anywhere near the 35 percent statutory tax rate they complain about all the time, pushing for even lower rates. They shelter their income offshore and find other loopholes to slash their tax bill, helping reduce the share they contribute to federal coffers.

With corporations and the wealthy paying less and less of their share, the burden of protecting society's most vulnerable is falling more and more to the people who can afford it least.

That started lonnnng before the ACA. That little trick started accelerating back when the economy was tanking under Bush's administration and companies realized they could get away with cutting all benefits to part timers that they hadn't already been able to cut from full time workers.

A perfect and prime example of that strategy was when Home Depot, who used to hire many professional tradesmen and pay decent wages hired Bob Nardelli from GE as their new CEO in 2000. His strategy was to cut workers and workers pay substantially. As a long time HD customer and stockholder my opinion is that this strategy almost ruined Home Depot. Luckily they wised up and fired Nardelli in 2006.

"Nardelli angered people by firing long-time Home Depot executives and bringing in GE alumni, according to Henderson. He also increased the number of less knowledgeable part-time workers at Home Depot’s stores, which left full-time employees fuming and led to a diminishment of customer service, one of the company’s strengths. From the very beginning of his tenure, Nardelli, now 58, “damaged morale, and he was seen as a real threat to the Home Depot culture,†Henderson says." http://knowledge.wharton.upenn.edu/...tenure-at-home-depot-a-blueprint-for-failure/

View attachment 34499

Can someone delete this, accidental post

Attachments

Do you realize that income taxes on the wealthy are at an all time low for this generation.

Since WWII until the late 60's tax rates on the rich were approx 90%. Then through the 80's the rates fell down into the 70's. It's now at 34% before deductions, loopholes, dodges and scams. Almost none of the rich actually pay that 34% which is quoted so often.

The rich just keep getting richer -- not only by gobbling up more income, but also by paying less in taxes. That means less support for the poor, who are getting increasingly poorer relative to the top one percent.

One chart in a new study of income inequality in developed nations, published by the National Bureau of Economic Research, puts this in stark relief. It shows that the more top tax rates are cut, the greater the share of national income that is mopped up by the wealthiest citizens.

And of course perhaps no country illustrates this better than the United States, which is at the extremes of income inequality and tax cuts for the wealthy, as you can see in the chart below. The only other nation that even comes close is the United Kingdom, which was hijacked by "trickle-down economics" at about the same time as the U.S., back in the 1980s under Reagan and Thatcher. (Story continues below infuriating chart.)

The U.K. has cut top tax rates more aggressively than the U.S. in the past few decades, but the U.S. still has a lower top marginal income tax rate -- 35 percent, compared to 50 percent in the U.K. And income inequality is far worse in the U.S., where the top one percent of households gets a fifth of all the nation's income. In the U.K., the income share of the top one percent is less than 15 percent.

Slashing top tax rates has had none of the positive effects on economic growth that the supply-side economists promised us, the NBER paper points out. Instead, it has just worsened income inequality.

There are other factors driving income disparity, including a rise in investment income (think stock dividends) compared to earned income (think wages). The recently soaring stock market, helped along by the Federal Reserve, is only pushing investment income higher. Wage income, in contrast, has been stagnant -- making income inequality even worse.

As if that weren't enough, investment income is typically taxed at lower rates, further amplifying the disparity. That means this chart doesn't begin to tell the full story of just how little the top one percent are paying in taxes. Mitt Romney isn't paying 35 percent on most of his income. He's calling his private-equity income "carried interest" and paying just 15 percent on it.

While Congress frantically finds ways to slash spending to close budget deficits, it has shown little interest in tweaking the tax code to make it more fair. Efforts to impose a minimum tax on millionaires, as Warren Buffett has suggested, have gone nowhere, as have efforts to do away with low carried-interest income tax rates. President Obama this year made permanent many of the top-rate tax cuts of President George W. Bush, while a payroll-tax cut that most benefited the poor was allowed to expire.

Similarly, U.S. companies aren't paying anywhere near the 35 percent statutory tax rate they complain about all the time, pushing for even lower rates. They shelter their income offshore and find other loopholes to slash their tax bill, helping reduce the share they contribute to federal coffers.

With corporations and the wealthy paying less and less of their share, the burden of protecting society's most vulnerable is falling more and more to the people who can afford it least.

That started lonnnng before the ACA. That little trick started accelerating back when the economy was tanking under Bush's administration and companies realized they could get away with cutting all benefits to part timers that they hadn't already been able to cut from full time workers.

A perfect and prime example of that strategy was when Home Depot, who used to hire many professional tradesmen and pay decent wages hired Bob Nardelli from GE as their new CEO in 2000. His strategy was to cut workers and workers pay substantially. As a long time HD customer and stockholder my opinion is that this strategy almost ruined Home Depot. Luckily they wised up and fired Nardelli in 2006.

"Nardelli angered people by firing long-time Home Depot executives and bringing in GE alumni, according to Henderson. He also increased the number of less knowledgeable part-time workers at Home Depot’s stores, which left full-time employees fuming and led to a diminishment of customer service, one of the company’s strengths. From the very beginning of his tenure, Nardelli, now 58, “damaged morale, and he was seen as a real threat to the Home Depot culture,” Henderson says." http://knowledge.wharton.upenn.edu/...tenure-at-home-depot-a-blueprint-for-failure/

Just wait till QE slows down a bit, banks will pull money out of the markets, and if interest rates go up, there goes the bond market. Hope you have a strategy for saving your ass. Esp if you are getting close to retirement age. Just sayin.....

First off, Apples and oranges or not, as far as I can tell we're still talking about the same things. While CEO's keep getting raises, the workers salaries have remained absolutely stagnant and in most cases has fallen. Why is that? Because the tremendous slack in the labor force. Thank The Great Recession for that. You can blame it on Clinton and I can blame Bush, it doesn't matter though. When corporations, who have no moral compass, realize they can pay less, they will. And you small business people have to do the same to compete. Personal tax rates have almost nothing to do with it.

Second, for an MBA I'm a little surprised that who didn't realized that QE has already ended and the stock market is doing just fine. In fact it's hit several new highs just this week.

I realize the market has hit record highs. That's why i said be prepared. But if you think the economy is heading in the right direction and everything is going well, keep drinking that kool aid.

I'll have my point of views and you keep yours. I'm happy you think all is well. I'll be of the opinion we are headed for tough times....but I'm guessing you will blame that on the GOP victory and continue to blame bush. talking points man, talking points.

But lets see what happens when rates increase ever so slightly on short term money. they are still near zero. Banks can load money into the market and not pay anything to those with deposits. When rates increase, that money will be pulled out, creating a selling frenzy, market will go down. Then at same time bond values will decrease since interest rates increase. Where would you suggest the person getting ready for retirement invest to protect?

I'll have my point of views and you keep yours. I'm happy you think all is well. I'll be of the opinion we are headed for tough times....but I'm guessing you will blame that on the GOP victory and continue to blame bush. talking points man, talking points.

But lets see what happens when rates increase ever so slightly on short term money. they are still near zero. Banks can load money into the market and not pay anything to those with deposits. When rates increase, that money will be pulled out, creating a selling frenzy, market will go down. Then at same time bond values will decrease since interest rates increase. Where would you suggest the person getting ready for retirement invest to protect?

I never said I think everything's rosy and the stock market will continue going up. And I don't necessarily blame anyone if it goes up or down. That's just a fact of life.

We've always got plenty of outside events to worry about from ISIS, China slowing, Russia flexing their muscle, Europe sliding back into recession. There's always a long list of possible meltdowns. But I do think the overriding net effect of our transformation from an importer of energy to net exporter will keep the US growth machine looking better than any of the other alternatives. Do you think it's just a coincidence that the lower oil prices are most affecting the 3 Countries that are currently considered our enemies, Russia (Europe's gas station), Venezuela and Iran? I think there's some serious global strategy going on that this administration will never take credit for.

Inflation, as you mention, has been the bogeyman that the anti QE people have been using for years and yet the Federal Reserve is still more worried about deflation and the fact they haven't been able to reach their target inflation point for quite a while.

So, yes I think we could have a crash, but no, I don't think it's imminent. I don't think Kool-Aid has any part in rational thinking. Nor does Fox News or MSNBC. They're just entertainment, not news channels.

We've always got plenty of outside events to worry about from ISIS, China slowing, Russia flexing their muscle, Europe sliding back into recession. There's always a long list of possible meltdowns. But I do think the overriding net effect of our transformation from an importer of energy to net exporter will keep the US growth machine looking better than any of the other alternatives. Do you think it's just a coincidence that the lower oil prices are most affecting the 3 Countries that are currently considered our enemies, Russia (Europe's gas station), Venezuela and Iran? I think there's some serious global strategy going on that this administration will never take credit for.

Inflation, as you mention, has been the bogeyman that the anti QE people have been using for years and yet the Federal Reserve is still more worried about deflation and the fact they haven't been able to reach their target inflation point for quite a while.

So, yes I think we could have a crash, but no, I don't think it's imminent. I don't think Kool-Aid has any part in rational thinking. Nor does Fox News or MSNBC. They're just entertainment, not news channels.

I don't want to jump into this and will probably not revisit this post because I am not sure any of us can have the answers because we simply don't have all the information. There is so much hidden from us "for our own good" bla, bla bla.

What I do know is, I would love to know where these loop holes are in the tax code that people talk about. I own a small business and file as an S corp. When I pay my taxes, because I live in a state with a state tax I pay 49% of my corp income in just state and fed tax. It is starting to make me think about retiring so I don't continue to pay into all this mess that is all around us.

BTW, this is a Republican and Demarcate problem and we need to start to realize that. Neither side has it right!

What I do know is, I would love to know where these loop holes are in the tax code that people talk about. I own a small business and file as an S corp. When I pay my taxes, because I live in a state with a state tax I pay 49% of my corp income in just state and fed tax. It is starting to make me think about retiring so I don't continue to pay into all this mess that is all around us.

BTW, this is a Republican and Demarcate problem and we need to start to realize that. Neither side has it right!

I don't want to jump into this and will probably not revisit this post because I am not sure any of us can have the answers because we simply don't have all the information. There is so much hidden from us "for our own good" bla, bla bla.

What I do know is, I would love to know where these loop holes are in the tax code that people talk about. I own a small business and file as an S corp. When I pay my taxes, because I live in a state with a state tax I pay 49% of my corp income in just state and fed tax. It is starting to make me think about retiring so I don't continue to pay into all this mess that is all around us.

BTW, this is a Republican and Demarcate problem and we need to start to realize that. Neither side has it right!

First thing you need to do is move to a State with no State income tax like Florida. Did I mention beautiful beaches?

I've owned several small corporations in my life and never found it difficult to shelter income. Not saying it's all legal but how many business owners run their household expenses through the corporation, including automobiles for them and their spouse, gas charges, Visa/MC bills, household maintenance items, etc? My guess is most. How many small business owners pocket cash that never goes into the taxable books? Most once again.

Sure you could be paying 49% total taxes but the key is on what. I'm quite sure it's not your gross income but your highly adjusted net income. How "highly adjusted" is the key. And I mean that in a very general way, not specific to you personally.

First thing you need to do is move to a State with no State income tax like Florida. Did I mention beautiful beaches?

I've owned several small corporations in my life and never found it difficult to shelter income. Not saying it's all legal but how many business owners run their household expenses through the corporation, including automobiles for them and their spouse, gas charges, Visa/MC bills, household maintenance items, etc? My guess is most. How many small business owners pocket cash that never goes into the taxable books? Most once again.

Sure you could be paying 49% total taxes but the key is on what. I'm quite sure it's not your gross income but your highly adjusted net income. How "highly adjusted" is the key. And I mean that in a very general way, not specific to you personally.

Amen.

D

d4m.test

Guest

Believe me, Phil, this listing is full of highly inaccurate ACCUSATIONS created by the Republican noise machine and its mouthpiece: Fox News and friends.

Many defy reason: e.g.

There's NO photo of Obama ever smoking a joint.

The cause of the decline of America's credit rating was courtesy of the Tea Party Extremists whose obstructionism created the crisis to begin with.

Obama NEVER CANCELED the National Day of Prayer -- an extremely Right Wing accusation. He merely held it in a different place (Check FACTCHECK.ORG for this).

He never said the USA was not a Christian nation (which it isn't, and the USG was NOT founded on the Bible, a lie Religious Right loves to peddle. The formal declaration denying the USA was a Christian nation: See President John Adams and the Treaty of Tripoli (1798). The Treaty passed the Senate with NO objections.

The charge that some Dems deserted him is true; the Democratic Party has become a party of COWARDS who lack the backbone to stand up and fight for their beliefs. Dems should have defended Obama, but they were too afraid of the Republican noise machine which would attack them anyway. These bums were more concerned about saving their political asses than standing up for their Party and country. They've become such spineless asses that I left the Party years ago. Their very cowerdice allowed the extremist Repubs to define the debate and shape the images and arguments. They deserved what they got -- the loss of control of the Senate, governorships, and more lost seats in the House.

I could go on and on. The rest of the accusations are so ridiculous and unfounded they don't deserve any comment at all -- just a hearty "Bronx Cheer."

Personally I'm so God-damned pissed at the rise of these true MEATHEADS and their conspiracy theories and related nonsense I can spit blood.

dave

Many defy reason: e.g.

There's NO photo of Obama ever smoking a joint.

The cause of the decline of America's credit rating was courtesy of the Tea Party Extremists whose obstructionism created the crisis to begin with.

Obama NEVER CANCELED the National Day of Prayer -- an extremely Right Wing accusation. He merely held it in a different place (Check FACTCHECK.ORG for this).

He never said the USA was not a Christian nation (which it isn't, and the USG was NOT founded on the Bible, a lie Religious Right loves to peddle. The formal declaration denying the USA was a Christian nation: See President John Adams and the Treaty of Tripoli (1798). The Treaty passed the Senate with NO objections.

The charge that some Dems deserted him is true; the Democratic Party has become a party of COWARDS who lack the backbone to stand up and fight for their beliefs. Dems should have defended Obama, but they were too afraid of the Republican noise machine which would attack them anyway. These bums were more concerned about saving their political asses than standing up for their Party and country. They've become such spineless asses that I left the Party years ago. Their very cowerdice allowed the extremist Repubs to define the debate and shape the images and arguments. They deserved what they got -- the loss of control of the Senate, governorships, and more lost seats in the House.

I could go on and on. The rest of the accusations are so ridiculous and unfounded they don't deserve any comment at all -- just a hearty "Bronx Cheer."

Personally I'm so God-damned pissed at the rise of these true MEATHEADS and their conspiracy theories and related nonsense I can spit blood.

dave

Two of my sons have married American girls, one from CA and one from VA. They have chosen to live in England, maybe because we're a little quirky and eccentric.

I've visited America many times and have some great friends there, even thought about moving there.

One thing I can't get my head around is how any president is hero worshiped by the voting public, almost seen as their saviour.

The following was posted on FB by an American friend of mine. True or not I don't know.

QUIT BASHING OBAMA

by COL. ROBERT F. CUNNINGHAM and PATRICK RISHOR

Quit trashing Obama's accomplishments. He has done more than any other President before hi...m. Here is a list of his impressive accomplishments:

First President to be photographed smoking a joint.

First President to apply for college aid as a foreign student, then deny he was a foreigner.

First President to have a social security number from a state he has never lived in.

First President to preside over a cut to the credit-rating of the United States.

First President to violate the War Powers Act.

First President to be held in contempt of court for illegally obstructing oil drilling in the Gulf of Mexico.

First President to require all Americans to purchase a product from a third party.

First President to spend a trillion dollars on "shovel-ready" jobs when there was no such thing as "shovel-ready" jobs.

First President to abrogate bankruptcy law to turn over control of companies to his union supporters.

First President to by-pass Congress and implement the Dream Act through executive fiat.

First President to order a secret amnesty program that stopped the deportation of illegal immigrants across the U.S., including those with criminal convictions.

First President to demand a company hand-over $20 billion to one of his political appointees.

First President to tell a CEO of a major corporation (Chrysler) to resign.

First President to terminate America ’s ability to put a man in space.

First President to cancel the National Day of Prayer and to say that America is no longer a Christian nation.

First President to have a law signed by an auto-pen without being present.

First President to arbitrarily declare an existing law unconstitutional and refuse to enforce it.

First President to threaten insurance companies if they publicly spoke out on the reasons for their rate increases.

First President to tell a major manufacturing company in which state it is allowed to locate a factory.

First President to file lawsuits against the states he swore an oath to protect (AZ, WI, OH, IN).

First President to withdraw an existing coal permit that had been properly issued years ago.

First President to actively try to bankrupt an American industry (coal).

First President to fire an inspector general of AmeriCorps for catching one of his friends in a corruption case.

First President to appoint 45 czars to replace elected officials in his office.

First President to surround himself with radical left wing anarchists.

First President to golf more than 150 separate times in his five years in office.

First President to hide his birth, medical, educational and travel records.

First President to win a Nobel Peace Prize for doing NOTHING to earn it.

First President to go on multiple "global apology tours" and concurrent "insult our friends" tours.

First President to go on over 17 lavish vacations, in addition to date nights and Wednesday evening White House parties for his friends paid for by the taxpayers.

First President to have personal servants (taxpayer funded) for his wife.

First President to keep a dog trainer on retainer for $102,000 a year at taxpayer expense.

First President to fly in a personal trainer from Chicago at least once a week at taxpayer expense.

First President to repeat the Quran and tell us the early morning call of the Azan (Islamic call to worship) is the most beautiful sound on earth.

First President to side with a foreign nation over one of the American 50 states (Mexico vs Arizona).

First President to tell the military men and women that they should pay for their own private insurance because they "volunteered to go to war and knew the consequences."

Then he was the First President to tell the members of the military that THEY were UNPATRIOTIC for balking at the last suggestion.

I feel much better now. I had been under the impression he hadn't been doing ANYTHING!!

D

d4m.test

Guest

Thanks for the post Phil ! What you have is a 'shortlist' actually, its so much more then that actually ! The honeymoon, or rather extended honeymoon of hope has ended. Whatever good that happened to America in recent years came about not because of this man, but because it would have eventually happen anyway! The country has awakened recently and cast its votes. Even his own party has shunned him in the last elections. And all for the better. Hope is on the horizon once more. A bit late. But there seems to be a glimmer. I hope for the better.

Sorry, S. but I vehementy disagree with these statements. Facing a Congress openly dedicated to making Obama a one-term president, trying to deal with an ideologically driven Republican party which proudly proclaimed itself as the "Party of No," obstructing and refusing to compromise with the man during his first two years in office, besieged by the party that constantly bashed him for every conceivable problem that occurred while refusing to acknowledge its of culpability, Obama has done quite well. The Tea Party extremist Republican party, now fueled by Big Money from the Koch Brothers and others, are eager to return to the policies and philosophies that made the W. Bush era a NIGHTMARE, complete with The Great Recession of '08 that destroyed the financial lives of so many people. With a conservative Republican Supreme Court that handed the country the democracy-destroying CITIZENS UNITED decision that allowed BIG BUSINESS/OIL to buy elections, I wouldn't put too much "hope" for a better future. It's like being in a dark tunnel and seeing a light coming towards you and mistakedly believing it's the end of the tunnel... . The American public is notoriously famous for its short attention span and lack of memory.

dave

SUMIKITO

Supporter and Senior Purveyor of YouTube News

Ok, to balance everything so folks can hear both sides of what is going on, well, here are tidbits of caffeine to maybe liven up some folks minds a bit on what is going on in our beloved country : http://www.charter.net/tv/3/player/..._deceit_mainstream_media_ignores_grub-foxnews .....now don't crucify me folks, after all, we all have our opinions, like they say, let the regular minded people decide, I just deliver the other side of the story to be fair. [note, this news bit is only good for perhaps 24 hours, so it may not be current later on. Google 'gruber on obamacare deciet' for current updates. ] ......Oh great, a Cadillac Tax, lets hear about it : http://www.charter.net/tv/3/player/...e_cadillac_tax-foxnews/source/Recommendations  and then this !! http://www.charter.net/tv/3/player/...ror_not_a_king-foxnews/source/Recommendations .......... God help our nation..........

and then this !! http://www.charter.net/tv/3/player/...ror_not_a_king-foxnews/source/Recommendations .......... God help our nation..........

SUMIKITO

Supporter and Senior Purveyor of YouTube News

Last time I looked at American Coinage it says "In God We Trust" ...................hmmmmmm. I pity those who don't realize what this nation is founded on. I really honestly do.

SUMIKITO

Supporter and Senior Purveyor of YouTube News

Let me check the bushes one more time for another 'jumping:sub4me:jack' ................. ok, all clear boys, bring out the shine !!

wankerdude

Renowned Member

- 18/8/13

- 550

- 7

- 18

Last time I looked at American Coinage it says "In God We Trust" ...................hmmmmmm. I pity those who don't realize what this nation is founded on. I really honestly do.

Say it isn't so!!!

Last time I looked at American Coinage it says "In God We Trust" ...................hmmmmmm. I pity those who don't realize what this nation is founded on. I really honestly do.

Thats great, but not everyone believes in god. Many of our founding fathers didn't, including Thomas Jefferson. You probably think that we live in a Christian nation too right?